FinOptions API

| Infocard

| ||||||||||||||||

| ||||||||||||||||

Financial library for valuing option prices

|

| 5.80 Mb |

Contents

Description by the Publisher

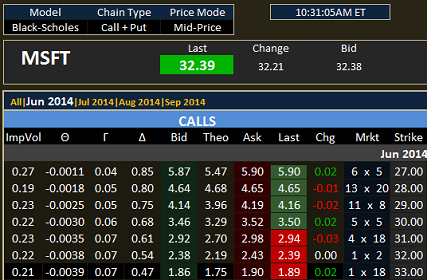

The FinOptions API analytics library is a comprehensive suite of derivative models with extensive cross asset coverage for the financial professional. Built to support the demand of today's financial markets, FinOptions API gives you the ultimate in accuracy and flexibility to handle complex products and obtain critical risk information required to drive your business objectives and manage your portfolio of derivatives.

Using market data from your quote vendor, FinOptions API allows you to value portfolio positions in real-time, including sensitivities such as delta, gamma, theta, vega, rho, psi and lambda or calculate implied volatility values based on the prices of exchange traded options.

With over 60 optimized financial functions, the Derivicom FinOptions API analytics library helps you deliver advanced, easy-to-create business solutions fast. Value options contracts on various assets including stocks, futures, indices, commodities, foreign exchange, fixed income securities, and Employee Stock Options (ESOs). Additionally, various exotic type contracts may be valued such as Average Price and Rate (Asian options), Barrier, Binary, Chooser, Compound, Currency-Translated, Lookback, Portfolio, Rainbow and Spread options. Complex interest rate and bond option pricing and analytics along with historical volatility evaluation and curve fitting functions are included in this comprehensive suite.

The FinOptions API is a straightforward and easy-to-use COM compliant financial software library powered by an ultra-efficient processing engine so that regardless of dataset size, you can analyze derivatives at lightning speeds.

The FinOptions API financial library enables you to quickly integrate advanced derivative analytics into your custom software solutions. From the intuitive object model to the clear and concise examples, the FinOptions API gives you the power to meet and exceed user expectations, today.

Limitations in the Downloadable Version

30-day trial version

Product Identity

Unique Product ID: PID-91005FD4C585

Unique Publisher ID: BID-C1006542E0C4