Medlin Accounting

| Infocard

| ||||||||||||||||

| ||||||||||||||||

Simple, easy to use, award winning software.

|

| 2.53 Mb |

Contents

Description by the Publisher

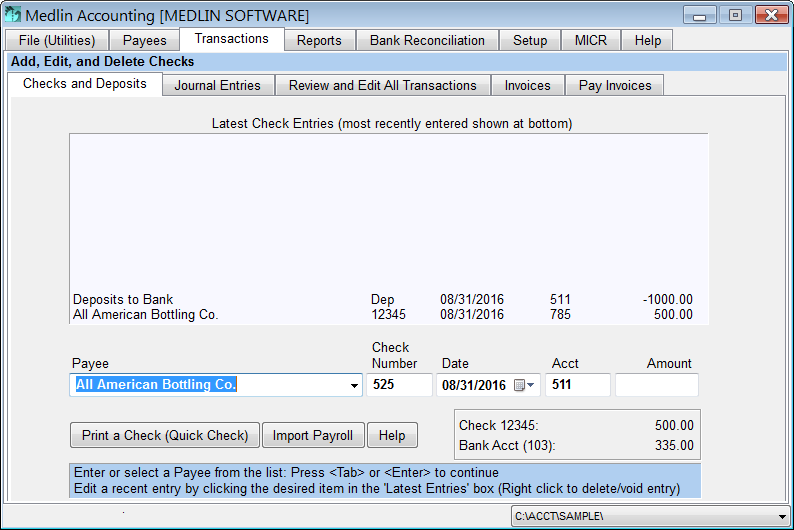

Simple, easy to use, award winning accounting Software. Author: Jerry Medlin - Shareware Hall of Fame - Recipient of the FIRST Shareware Industry Award for Best Business and Financial Software. PAYROLL: 941 and 940 printing - DE88, DE9, and DE9C printing - NYS-45 printing - W2 and W3 printing - Magnetic Media filing is available - Built in Federal, State, Social Security, and Medicare calculations - Supports: Fixed deductions, Retirement , Section 125, Cafeteria Plans, Tips, Advanced EIC, Multi-State Payrolls, etc. - Paychecks can be posted into Medlin Accounts Payable. MEDLIN ACCOUNTING: Handles over 30,000 transactions per month - Includes an easily modified Chart of Accounts - Easily edit transactions in the current and prior year - Recurring entries - Bank Reconciliation - Balance Sheet - Income Statement - Trial Balance - General Ledger Report - Account Summary - Transaction Listing - Budget reports can be printed with the Medlin Budget program. ACCOUNTS RECEIVABLE and INVOICE WRITING: Up to 10,000 customers - Allows over 30,000 transactions per month - Up to 5000 Sales Codes (product or service categories) - Two Auto Bill amounts - Each customer can be set for one of five tax rates, or as tax exempt - Reports include: Customer Listing (aged balances), Statements, Invoices, Accounts Receivable Ledger, Sales Tax Summary, Charges and Payments Listing, Customer Activity, Sales Summary, and Delinquent Customer Listing - Saves up to 99 months of data - Can post the charges and payments to Medlin General Ledger. ACCOUNTS PAYABLE: Up to 4600 Vendors - Handles over 30,000 checks and deposits per month - Reads payroll Checks from Medlin Payroll - Posts checks and deposits directly into Medlin General Ledger - Fills in 1099 forms.

Limitations in the Downloadable Version

30 Day Trial

Product Identity

Unique Product ID: PID-7200B713B637

Unique Publisher ID: BID-A10091ABA437

[Medlin Accounting PAD XML File]